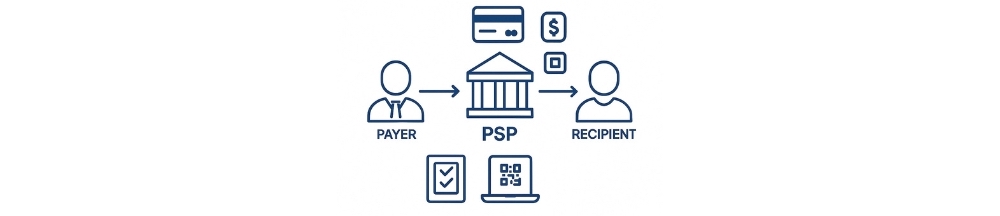

In the realm of financial services, particularly in Georgia, the operation of payment services is under regulatory oversight. This framework aims to ensure transparency, security, and stability in the payment sector. At the center of this regulatory system are Payment System Providers (PSPs). They play a crucial role in facilitating various payment transactions.

PSPs include a range of entities such as commercial banks, microbanks, and microfinance organizations. These entities act as intermediaries between users and the payment infrastructure. They enable the smooth transfer of funds and the execution of payment transactions.

Registration Requirements for PSPs

PSPs are required to register with the National Bank of Georgia (NBG). This regulation ensures compliance with statutory rules and protects the interests of consumers and stakeholders. However, commercial banks, microbanks, and microfinance organizations are automatically authorized to provide payment services under Georgian law. As a result, they are not subject to the PSP registration requirement. Any other entity that intends to offer payment services must register as a PSP with the NBG.

In the Georgian market, several prominent entities have established themselves as major players in the provision of payment services. Notable among these is a leading commercial bank such as JSC TBC Bank. Additionally, brands such as CPAY, OPPA, and eMoney Georgia have also registered as PSPs in Georgia.

The Scope of the Services Provided by PSP

Georgian law authorizes the PSP to perform the following:

- Services that ensure the debiting of funds from the payer’s account and related transactions;

- Services related to the crediting of funds to the recipient’s account and related transactions;

- Making payments through direct debits (including one-off orders), payment cards, or other electronic means, as well as credit transfers (including standing orders) within the funds or credit resources of a payment service user;

- Issuance and/or acquisition of payment instruments, including electronic money instruments;

- Execution of remittances;

- Issuance of electronic money (issuance of tokens, e.g., via an ICO and the exchange of fiat money into cryptocurrencies and the exchange from cryptocurrencies back into fiat money), along with the implementation of payment transactions through electronic money, utilizing methods such as mobile phones, the Internet, or other electronic means;

- Execution of payment transactions based on the consent of the payer given using telecommunication, digital, or IT devices, to or in favour of the telecommunication, IT system, or network operator that acts as an intermediary between the payer and the payee, as well as between the user and the supplier of goods or services; and

- Provision of payment initiation services.

Therefore, entities that want to undertake any of the above activities must register as a PSP with the NBG.

Procedure for Registration of PSP

To initiate the registration process, entities must first establish a legal entity and then provide a comprehensive set of documents to the NBG. The required set of documents includes general information about the entity, a comprehensive list of payment services, details about the administrators of the PSP, information about significant shareholders, beneficial owners, or individuals with significant influence, and other documents related to the payment system.

All documents must be either original or notarized copies, with foreign documents legalized and translated into Georgian.

Moreover, the NBG has the authority to request additional information or documents from the entity as needed to complete the registration process. At any stage, the NBG may ask the entity to demonstrate the electronic system used for payment services. It may also request access to employees at the head office for assessment purposes.na

If the documentation provided by the entity does not meet the stipulated requirements, the NBG will allow 30 calendar days to correct the deficiencies or clarify the submitted data. Once the documentation meets the NBG’s requirements, it will be thoroughly reviewed within 60 calendar days. During this period, the NBG may also request additional information if necessary.

Upon successful registration, the NBG issues an administrative document confirming the entity’s status as a registered PSP, along with details of authorized payment services.

Provision of Payment Services After Obtaining Approval by NBG

Georgian law requires no extra payments to the NBG except the GEL 5,000 application review fee. However, Georgian legislation does establish general regulations applicable to all PSP companies, including rules for their administrators.

The administrator of a PSP is a member of the supervisory board, a member of the board of directors, or an individual authorized to independently undertake obligations on behalf of the PSP. The administrators overseeing PSP activities must meet the specific criteria, including:

- No record of serious criminal offenses;

- Compliance with financial regulations;

- Compliance with fiduciary duties;

- Relevant education and managerial experience in finance or related fields.

Moreover, Georgian legislation categorizes PSPs as accountable entities under Anti-Terrorism and AML laws, mandating compliance with their provisions. Specifically, these laws require PSPs to conduct customer identification and verification using reliable and independent sources, as well as identify beneficial owners, and to undertake reasonable measures to verify their identity based on credible sources.

Additionally, PSPs are obligated to monitor their business relationships with customers to ensure compliance with the Anti-Terrorism and AML laws of Georgia.

In conclusion, Georgia’s PSP regulatory framework highlights strict guidelines ensuring transparency, security, and accountability in the financial sector. The registration procedures reflect the careful process required to gain approval from the NBG.

They also emphasize the important role PSPs play in facilitating payment transactions in the country. By properly registering and meeting regulations, entities support Georgia’s payment infrastructure and contribute to transparency, trust, and economic growth.

If your company plans to offer payment services in Georgia, understanding and following these regulatory requirements is crucial.